Art FinTech App

A web app for art lovers to purchase artworks from participating galleries, spreading their payment over ten monthly instalments, completely interest-free.

Art Money

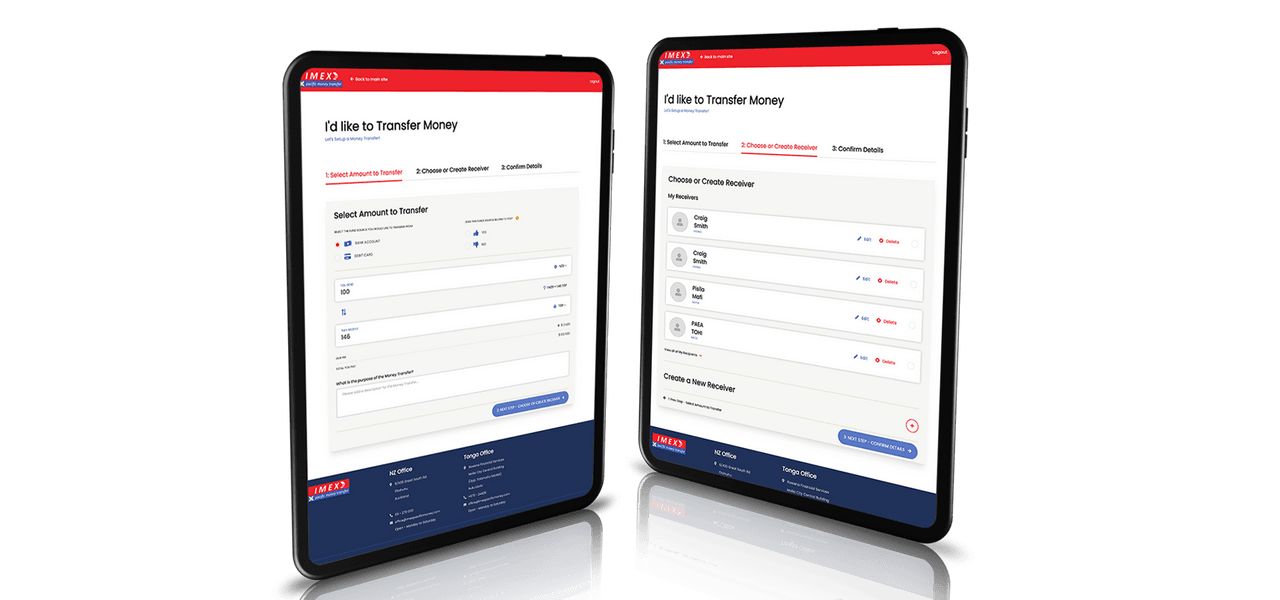

IMEX have been serving their community for over 20 years, facilitating money transfers between New Zealand and Tonga. This is a family-run business, but that doesn’t limit their ambition and appetite for growth.

Recently they’ve expanded their service to include Samoa and have big plans to take on a number of other countries in the Pacific and beyond.

IMEX pride themselves on providing a fast secure payment service in a way that makes sense for their Pacifica community. In order to offer this to a wider audience, the first project for Custom D was to get their payment transfer system online.

A combination of cross-platform digital technologies (Laravel and React) were used in transforming this traditional business to a modern Fintech.

imexpacificmoney.com

Windcave was selected as the best NZ-based payment provider for this project, and seamlessly integrated into the application.

Some specific requirements for this project included restricting users to only use debit cards, as credit cards were not permitted. There’s also a maximum amount that can be transferred automatically.

Measures had to be put in place in order to comply with strict Anti Money Laundering (AML) laws. Users must upload proof of identity and address, and both need to be approved by IMEX staff.

With data breaches in the news every day, data encryption was an absolute must for IMEX. It’s increasingly difficult to protect systems that store the type of sensitive data held by IMEX. We have implemented a world-class encryption strategy. The system is not only encrypted, but additionally all the data is separated – if an account is compromised, the hacker would only be able to access that single account and not be able to gain access to any of the other system data.

Critical to scaling any business is operational efficiency. Investing in their online service, allows IMEX to reduce the amount man hours needed to process transfers allowing them to do more with less. They’ve been able to capitalise on tech savviness of their younger users, who value the convenience of doing things when they want from anywhere with an internet connection.

A web app for art lovers to purchase artworks from participating galleries, spreading their payment over ten monthly instalments, completely interest-free.

Art Money

An online portal for customer orders, seamlessly integrated with VSE's back-end system.

VSE International